The Invisible Shift: 7 Survivalist Trends in Ad Monetization for 2026

The digital ad monetization landscape of 2026 looks nothing like the programmatic playbook we followed five years ago. The “Great Deprecation” of third-party cookies is old news. What’s replaced it is far more complex: autonomous AI negotiation systems, a regulatory patchwork that makes GDPR look straightforward, and a fundamental battle for human attention measured in milliseconds rather than impressions.

For publishers and digital media owners—especially those in web gaming, content, and creator tools—survival means more than just “getting ads on the page.” It means navigating an ecosystem where AI search engines siphon your traffic before users even click, and where regulators scrutinize every byte of user data with unprecedented intensity.Here are the seven defining trends separating high-yield leaders from legacy laggards in 2026, along with what you need to do about them right now.

Contents

- 1 1. Agentic AI Bidding: When Machines Negotiate With Machines

- 2 2. The Privacy Patchwork: State-Level Regulations That Make GDPR Look Simple

- 3 3. Supply Path Optimization and the MFA Purge

- 4 4. Data Clean Rooms: The New Identity Standard

- 5 5. The Zero-Click Yield Pivot

- 6 6. Attention Metrics vs. Viewability: The Fight for “Eyes-On”

- 7 7. Retail Media Off-Site Extension: Your Site as a Storefront

- 8 The 2026 Ad Monetization Playbook

1. Agentic AI Bidding: When Machines Negotiate With Machines

We’ve moved past simple programmatic bidding. In 2026, ad monetization has embraced what’s being called “Agentic AI”—autonomous systems that don’t just execute bids, but negotiate advertising strategy in real-time.

The Technology: Ad Context Protocol (AdCP)

The breakthrough this year is widespread adoption of the Ad Context Protocol. In the past, your ad server talked to a demand-side platform. Today, your ad stack communicates directly with a user’s personal AI assistant. Here’s how it works: If a user is currently using an AI agent to plan a vacation, AdCP allows your monetization layer to signal: “I have a high-intent user currently viewing Amalfi Coast itineraries; what’s the most relevant, non-intrusive offer you can provide right now?” The AI agent on the buy-side responds with a contextually perfect ad—and pays a premium for it.

The Strategy for Publishers

To capture higher CPMs, publishers are moving toward hybrid ad stacks that combine traditional Real-Time Bidding (RTB) with these new AI negotiation layers. The result? A significant reduction in irrelevant ads and a measurable spike in yield. Early adopters report CPM increases of 40-60% for AI-negotiated inventory compared to standard programmatic. The reason: AI agents on the buy-side are willing to pay premiums for guaranteed context matches. They’re optimizing for conversion, not just impressions, and they’ll pay for precision. Action Item: Evaluate whether your current ad tech stack supports AdCP integration. If you’re still running a purely RTB-based system, you’re leaving money on the table.

2. The Privacy Patchwork: State-Level Regulations That Make GDPR Look Simple

The dream of a single federal privacy law in the United States remains unfulfilled. Instead, 2026 has delivered a complex patchwork of aggressive state-level laws that create operational nightmares for publishers pursuing effective ad monetization.

The “Neural Data” Frontier

The most significant shift in 2026 is the legal classification of “neural data” and “precise geolocation” as highly sensitive information. States like Oregon (OCPA), New Jersey, and Colorado now regulate data down to 1,750 feet as protected. If your ad stack is broadcasting exact coordinates to an open exchange without granular consent, you’re a walking liability. Texas and Virginia have made it virtually impossible to monetize users under 16 without high-friction parental consent. If you can’t verify age at the gate, you’re better off darkening ad units for those segments entirely to avoid catastrophic fines.

Your 2026 Action Plan

First, audit your Consent Management Platform (CMP) immediately. By now, your system must support Global Privacy Control (GPC)—the universal opt-out signal—by default. This isn’t optional; it’s legally mandated in several states. Second, evaluate whether your ad tech provider has built-in compliance. The cost of maintaining compliance in-house ranges from $10K to $50K annually when you factor in legal review, CMP subscriptions, and ongoing monitoring. Platforms like AppLixir that offer built-in TCF 2.2 certified GDPR compliance aren’t just convenient; they’re strategic cost-savers that eliminate this entire compliance burden.

Publishers with robust privacy compliance aren’t just avoiding fines—they’re winning premium demand. Brand-safe advertisers are explicitly filtering for “compliant inventory” in their buying criteria. If your consent flows are clean and transparent, you’ll see it in your CPMs. Web-first ad monetization platforms that build compliance into their core architecture deliver this advantage by default, eliminating the need for publishers to become compliance experts themselves.

3. Supply Path Optimization and the MFA Purge

The era of the middleman is over. In 2026, the programmatic supply chain has been aggressively pruned. Advertisers are no longer willing to pay the “ad tech tax” that previously saw only 30-40 cents of every dollar reaching publishers. If your ad-to-content ratio exceeds the new “Golden Ratio” of 2026 (typically 30% ad real estate), AI-driven filters will ghost your inventory. You won’t just get lower bids; you’ll get no bids at all.

Keep a relentless eye on your Sellers.json and Ads.txt health. Premium buyers now prioritize “Direct” or “Primary Aggregator” paths. If your inventory is being resold through multiple sub-exchanges, your “Path Score” will drop, excluding you from the most lucrative “Green” (efficient) supply paths. The numbers tell the story: Publishers with direct supply paths are seeing CPMs 80-120% higher than those going through three or more intermediaries. The transparency matters, and it’s measurable.

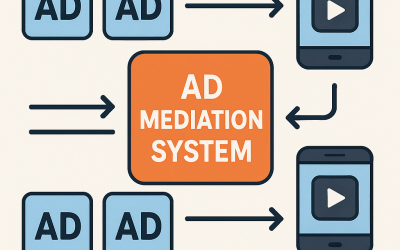

Web-first publishers have a distinct advantage here. Unlike mobile apps that often rely on multiple SDK layers and mediation partners, web ad monetization platforms can maintain cleaner, more direct paths to demand. Web-native solutions that connect directly to 30+ premium demand partners—rather than mobile-ported SDKs with complex mediation waterfalls—deliver superior transparency and yield. This architectural advantage is why web-first ad monetization is increasingly becoming the gold standard for publishers who prioritize both revenue and operational simplicity.

4. Data Clean Rooms: The New Identity Standard

With third-party cookies dead and buried, the “handshake” between brands and publishers has moved into Data Clean Rooms (DCRs).

The Technology: Privacy-Safe Matching

DCRs are secure, cloud-based environments where you and an advertiser can “match” first-party data without ever seeing raw details. You provide the audience; they provide the customer list. The DCR finds the overlap using Differential Privacy—a method of adding mathematical “noise” so that while trends are clear, individual users remain anonymous.

In 2026, premium advertisers are prioritizing publishers integrated with platforms like Snowflake, Habu, or InfoSum. If you don’t have a DCR strategy, you’re locked out of approximately 80% of Fortune 500 direct spending. The practical implication: Publishers who can offer DCR-matched audiences are commanding CPM premiums of 3-5x compared to standard contextual targeting. The brands get precision; you get paid for it.

5. The Zero-Click Yield Pivot

This is perhaps the most painful transition for legacy publishers. AI search engines—Google’s AI Overviews, Perplexity, Apple Intelligence—are now answering user queries directly on search results pages. Early 2026 data suggests publishers have lost an average of 25% of their organic referral traffic.

The Pivot: From Clicks to Citations

Since users aren’t clicking through, you must monetize the answer itself. This is called Citation Equity. High-tier publishers are negotiating Direct Licensing Agreements with AI model training companies.

Monitor your AEO (Answer Engine Optimization) visibility. When an AI agent quotes your content to a user, it should trigger a “micro-attribution” signal. Look for ad tech partners offering “Sponsored Citation” units, where advertisers pay to be the “Recommended Product” within an AI-generated answer using your content as the source. For gaming publishers specifically, this means ensuring your game guides, strategy content, and reviews are structured for AI consumption. The traffic may not click through, but the attribution—and the associated ad monetization opportunity—can follow.

6. Attention Metrics vs. Viewability: The Fight for “Eyes-On”

In 2026, “Viewability” is a legacy metric. Just because an ad was on-screen for two seconds doesn’t mean the human actually saw it. The industry has shifted to Attention-Based Bidding, fundamentally changing how successful ad monetization works.

The Technology: Eye-Tracking and Velocity

Ad networks now use “Scroll-Depth Velocity” and, where users have consented, “Edge-AI Eye Tracking” to calculate an Attention Score in real-time. Premium advertisers are setting floor prices based on Active Seconds of Attention. If a user stays on a specific section of your long-form article for 15 seconds, the CPM for the ad unit in that viewport spikes in real-time. To capitalize on this, you need “High-Dwell” ad units—sticky, interactive widgets or “Scrollytelling” formats that keep users engaged longer than standard banners ever could.

Rewarded Video Ads: The Attention Advantage

For web games and interactive content specifically, rewarded video ads have emerged as the premium format in this attention-based economy. Unlike passive display ads, rewarded video ads deliver guaranteed attention because users actively choose to engage with them in exchange for in-game benefits or premium content access.

The metrics prove it: rewarded video ads consistently achieve 100% completion rates and 15-30 seconds of active attention per impression—numbers that passive formats simply cannot match. In an attention-based bidding environment, this translates directly to premium CPMs. Publishers using rewarded video ads are seeing CPMs of $8-15, compared to $2-4 for standard display inventory.

The key is choosing a platform designed specifically for web-first rewarded video ad delivery rather than mobile-ported solutions that treat web as an afterthought. Web-native rewarded video ads load faster, perform better, and integrate more seamlessly into browser-based experiences—all factors that drive higher completion rates and better monetization outcomes.

7. Retail Media Off-Site Extension: Your Site as a Storefront

Retail Media Networks (RMNs) from Amazon, Walmart, and Uber have moved “off-site.” They’re no longer content with showing ads only on their own apps; they want to find their customers wherever they are—including on your site.

The Mechanism: Verified Buyer Targeting

When a user lands on your site, an advertiser isn’t just buying “Tech Reader” or “Gamer.” Through identity bridges like ID5 or The Trade Desk’s UID2.0, they recognize that this specific reader has a “Verified Purchase History” for high-end laptops or gaming peripherals. This allows you to serve “Shoppable Ads” that connect directly to a user’s existing retail cart. Because these ads have significantly higher conversion rates, CPMs are often 3-5x higher than standard display ads. Integration with these identity frameworks isn’t optional; it’s the primary engine of high-yield ad monetization in 2026.

For gaming publishers, this is particularly powerful. A user playing a free-to-play game with ads who has previously purchased gaming accessories becomes premium inventory for peripheral manufacturers, game publishers, and even streaming services. When combined with rewarded video ad formats—where users opt in for the experience—conversion rates spike even higher because the engagement is intentional rather than interruptive.

The 2026 Ad Monetization Playbook

The theme for 2026 is Precision over Presence. The days of “spray and pray” ad loading are over. Success belongs to publishers who treat their data as a strategic asset, their ad stack as a negotiation engine, and their users’ attention as a finite, precious resource.

Your Action Checklist:

- Audit your privacy compliance – Is your CMP GPC-ready? Are you TCF 2.2 certified, or using a platform like AppLixir with built-in compliance?

- Check your supply path – How many hops exist between you and premium demand?

- Evaluate AI readiness – Does your stack support AdCP or similar agentic bidding?

- Review your metrics – Are you still optimizing for viewability, or have you moved to attention-based pricing?

- Assess your identity strategy – Do you have DCR partnerships or identity framework integrations?

- Optimize for attention – If you’re not leveraging rewarded video ads for high-engagement inventory, you’re missing the highest-performing format in the attention economy.

The publishers winning in 2026 aren’t necessarily the biggest—they’re the most adaptable, the most compliant, and the most strategically integrated with the new infrastructure of digital ad monetization. For web publishers specifically, this means choosing platforms built for web-first experiences rather than mobile-ported solutions, prioritizing formats like rewarded video ads that deliver guaranteed attention, and partnering with providers who handle compliance, supply path optimization, and premium demand access as core features rather than add-ons.