November CPM and Fill Rate Trends For Web Games: A 3-Year Breakdown

Every year, as Q4 budgets kick in, advertisers flood the market with demand. Video ads perform at their peak. And if you’re running rewarded video ads in your mobile or web game, November is your Super Bowl. But here’s the thing: it’s not just about how much advertisers are willing to pay. It’s about whether you can actually serve those ads to your players. That’s where CPM and fill rate come into play—and trust me, the story they tell is a lot more interesting than you might think.

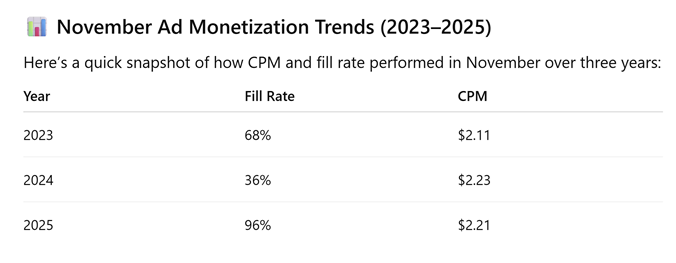

I’ve been tracking November performance from 2023 to 2025, and the trends are wild. We’re going to break down what happened, why it matters, and—most importantly—how you can use this insight to crush it in 2026.

Contents

Fill Rate and CPM: Why Both Matter

Fill rate is the percentage of ad requests that actually get filled with an ad. Think of it like this: if your game requests 100 ads and only 70 get served, your fill rate is 70%. The higher this number, the more opportunities you have to make money.

CPM (cost per mille) is what advertisers pay for every 1,000 impressions. Higher CPM means you’re making more per ad view.

Here’s the catch: you need both working together. A sky-high CPM means nothing if most of your ad requests go unfilled. And a perfect fill rate with terrible CPMs? You’re basically working for peanuts.

The magic happens when both metrics are strong. That’s when revenue actually flows.

2023: Stable, Predictable, But Not Exciting

November 2023 was… fine. A 68% fill rate paired with a $2.11 CPM gave us a baseline that felt safe and predictable. For developers running rewarded video ads—whether in HTML5 games, Unity apps, or mobile games—this was a year you could count on. Advertiser demand was steady. DSPs were running at full capacity. And if you were using a decent monetization platform, you could actually forecast your revenue with some confidence.

But let’s be real: that 32% of missed impressions? That’s money left on the table. Especially if you were in fast-growing verticals like WebGL or cross-platform gaming, those gaps hurt. It wasn’t a bad year. It just wasn’t optimized.

2024: The Year Everything Broke

And then came 2024. Fill rates tanked to 36%. Yes, CPM ticked up slightly to $2.23, but when two-thirds of your ad requests aren’t being filled, that higher CPM doesn’t mean much.

This was the year that reminded everyone: you can’t spend ads you can’t serve. So what went wrong? A few things:

- Privacy changes tightened targeting, especially on mobile. Advertisers couldn’t reach users the way they used to, so they pulled back inventory.

- Attribution tracking issues made some advertisers nervous. When they couldn’t measure performance accurately, they reduced spend.

- Network-level problems—whether it was mediation misconfigurations or DSP outages—created massive fill gaps that shouldn’t have existed.

For developers relying on rewarded video ads, this was a nightmare. Even though CPM looked decent on paper, ARPDAU (average revenue per daily active user) dropped hard because there just weren’t enough ads to show.

The lesson? A high CPM is worthless if the ad never loads.

2025: The Comeback We Needed

And then 2025 happened, and everything clicked. Fill rates exploded to 96%. CPM held strong at $2.21. This was the year when all the pieces finally came together.

What changed?

- Smarter mediation platforms started routing impressions more efficiently. Instead of relying on one or two networks, developers could tap into multiple demand sources seamlessly.

- Demand-Side Platforms leveled up their machine learning. They got better at matching inventory with advertiser demand in real time.

- Global campaigns expanded. More advertisers ran Q4 campaigns, which meant wider demand across regions and genres.

Developers using Unity rewarded ads, HTML5 web games, or mobile app ads finally hit the sweet spot: high fill rate + strong CPM = real money per user. And if you were tracking LTV or using an ad revenue calculator, 2025 probably gave you your best numbers in years.

Bonus win: Video completion rates stayed above 90%, which boosted eCPM and kept players engaged. Rewarded video ads proved—again—that they’re the best format for free-to-play monetization.

What’s Coming in 2026?

So where do we go from here? Based on the trends and what I’m seeing in the ecosystem, here’s what I expect for November 2026:

Prediction #1: CPMs Will Push Higher, Especially on Web

With more eCommerce brands, retail giants, and AI startups flooding the ad market, I think Q4 CPMs could break $2.30—particularly for web games and premium mobile inventory. The sweet spots will be:

- Games with long play sessions

- High-retention apps

- Desktop browser-based games (thanks to expanding WebGL support)

Prediction #2: Fill Rates Will Stay High—If You Stay Updated

Developers who keep their SDKs current and their integrations clean will continue seeing fill rates in the 90%+ range. But here’s the warning: outdated SDKs or broken setups will get punished. The gap between optimized and under-optimized games is going to widen.

Prediction #3: eCPM Becomes the Metric That Matters

Raw CPM is fine, but effective CPM (eCPM) will matter more. This includes:

- Actual revenue per request after mediation takes its cut

- Revenue per engaged user, not just per 1,000 impressions

Prediction #4: AI Will Make Ad Targeting Smarter

AI-powered personalization is already improving, and it’s going to refine ad placements even further. Games with highly engaged users—like HTML5 games, Unity apps, and platforms with rich user data—will see better CPMs because ads will be more relevant.

Your 2026 Monetization Checklist

If you want to crush it next November, start preparing now:

✅ Use a reliable video monetization platform

✅ Integrate multiple ad networks through mediation

✅ Prioritize ad engagement over sheer quantity

✅ Start prepping your Q4 strategy in Q3—don’t wait until October

✅ Monitor fill rate and CPM weekly, not monthly

How to Optimize Both Fill Rate and CPM

Alright, enough predictions. Let’s talk action steps.

1. Diversify Your Ad Demand with Mediation – Don’t rely on a single ad network. Use a monetization platform that connects you to multiple DSPs. If one network lags, others can fill the gap. This is how you protect your fill rate.

2. Optimize Placement and Engagement – Don’t just slap rewarded videos anywhere in your game. Test placements that align with natural gameplay moments—level completions, upgrade opportunities, bonus unlocks. Make the reward worth it. Offer in-game currency, power-ups, or bonus levels. “Watch to continue” is weak. “Watch to double your rewards” performs way better.

3. Test Across Devices – HTML5 games work across desktop and mobile, but users engage differently on each platform. Optimize your ad strategy per device. Desktop users might watch longer ads; mobile users might prefer shorter ones.

4. Track eCPM and ARPDAU Weekly – Use dashboards or analytics tools to calculate effective CPM and ARPDAU every week. Don’t wait until the end of the month to realize something’s broken. Adjust in real time.

5. Keep Your SDKs Updated – This is non-negotiable. An outdated rewarded video SDK can destroy your fill rate. Make sure everything is up to date before November hits—or better yet, before Q4 even starts.

Summary – AppLixir Monetization

From 2023 to 2025, we’ve learned one thing loud and clear: CPM and fill rate need to work together. 2023 was stable but unoptimized. 2024 had strong CPMs but terrible fill rates, which killed revenue. 2025 brought both metrics together, and developers finally saw the payoff. As we head into 2026, the opportunity is there. Rewarded video ads are still one of the highest-performing formats for both engagement and revenue. But only if you optimize for both CPM and fill rate. So start early. Test often. Stay updated. And when November 2026 rolls around, you’ll be ready to make it your best month yet.