How to Use Real Data to Predict Rewarded Ads CPM & Revenue

Inaccurate CPM projections lead to underperformance, misallocated resources, and misinformed monetization strategies that can derail promising apps. The difference between guessing and knowing can mean thousands of dollars in missed revenue or, worse, burning through your user base with poorly optimized ad placements.

The good news? You don’t have to guess. By leveraging real data and using ad revenue calculators strategically, you can predict rewarded video ads earnings with remarkable accuracy. In this guide, we’ll walk you through the data sources you need, how CPM actually works in practice, the tools that make forecasting easier, and actionable strategies to predict—and optimize—your future earnings.

Contents

- 1 What Is CPM and Why It’s Not Just a Vanity Metric

- 2 Why Developers Get CPM Predictions Wrong

- 3 Data Sources You Need to Predict Rewarded Video Ads Revenue

- 4 Using an Ad Revenue Calculator to Forecast Earnings

- 5 Segmenting CPM by Geo, Device, and Ad Placement

- 6 Optimizing for Higher CPM and Better Rewarded Video Ads Earnings

- 7 Predicting Future CPM Trends with Historical Data

- 8 AppLixir Summary: Don’t Leave Rewarded Ad Revenue to Chance

What Is CPM and Why It’s Not Just a Vanity Metric

CPM stands for Cost Per Mille, which translates to the cost per 1,000 impressions. In practical terms, it’s what advertisers pay for every thousand times their ad is shown to users. For developers, CPM represents the baseline earning potential of your ad inventory.

But here’s where many developers get confused: CPM and eCPM are not the same thing. CPM is the rate advertisers bid for impressions, while eCPM (effective CPM) is what you actually earn after accounting for fill rates, ad performance, and network fees. Your eCPM is your true revenue metric—it reflects real-world performance, not theoretical maximums.

In the context of rewarded video ad revenue, CPM becomes even more critical. Unlike banner ads that users passively scroll past, rewarded ads require active engagement. Users choose to watch them in exchange for in-game currency, extra lives, or premium content. This opt-in nature typically commands higher CPM rates because engagement is guaranteed, completion rates are high, and advertisers value the positive user sentiment.

Understanding CPM isn’t about chasing vanity metrics—it’s about recognizing how ad pricing models directly translate to your bottom line. Every dollar of CPM variance across thousands of impressions compounds into significant revenue differences over time.

Why Developers Get CPM Predictions Wrong

Despite CPM’s importance, developers consistently miscalculate their rewarded video ad revenue. The mistakes usually fall into three categories.

First, they rely on outdated CPM benchmarks. That article from 2022 claiming $10 CPM for US traffic? The ad market has shifted. Advertiser budgets fluctuate, competition changes, and platform algorithms evolve. Using stale data guarantees inaccurate forecasts.

Second, developers assume static rates across geographies and devices. The reality is far more complex. A US iOS user might generate $12 eCPM while a user in India on an Android device brings in $2. Treating all impressions equally in your calculations creates massive prediction errors, especially as your user base diversifies.

Third, many developers ignore fill rates and user behavior patterns. You might have impressive impression potential, but if your fill rate is only 70% and only 40% of users actually opt into your rewarded ads, your actual revenue will fall dramatically short of theoretical maximums.

Rewarded ads behave fundamentally differently than banners or interstitials. They require user initiation, have higher completion rates, and typically generate superior CPMs—but they also depend heavily on UX implementation and reward design. Ignoring these behavioral nuances while projecting revenue is like building a house on sand.

Data Sources You Need to Predict Rewarded Video Ads Revenue

Accurate revenue prediction requires five core data points, all of which should be tracked continuously and segmented properly.

Impressions are your foundation—the total number of rewarded ad views delivered. This seems straightforward, but you need to track both requested and filled impressions to understand your true inventory.

Fill Rate measures what percentage of ad requests actually return an ad to display. A 100% fill rate is rare; most apps see 70-90% depending on their ad stack and user geography. Low fill rates directly reduce revenue regardless of CPM.

User Opt-in Rate tracks how many users actually choose to watch your rewarded ads when offered the opportunity. This metric reveals how compelling your reward structure is and how well-integrated your ads are into the user experience. A game with 100,000 daily active users but only 15% opt-in rate has very different revenue potential than one with 60% opt-in.

Ad Completion Rate shows what percentage of users who start a rewarded ad watch it through to completion. For rewarded videos, this should be high (typically 85-95%) since users are incentivized to finish. Lower rates signal UX problems or technical issues.

eCPM by Geo & Device is your most granular and valuable metric. CPM for a US iOS user can be 5-10x higher than a tier-3 country on Android. Without geographic and device segmentation, your revenue predictions will be wildly inaccurate.

Where do you collect this data? Video monetization platforms like AppLixir, Unity Ads, and AdMob provide detailed reporting dashboards with most of these metrics. For user behavior data—particularly opt-in rates and session patterns—analytics tools like Google Analytics, Firebase, and AppsFlyer fill in the gaps. The key is connecting ad performance data with user behavior data to build a complete picture.

Using an Ad Revenue Calculator to Forecast Earnings

Once you have reliable data, an ad revenue calculator transforms raw numbers into actionable revenue projections. The fundamental formula is elegantly simple:

Revenue = (Impressions / 1,000) × eCPM

Let’s work through a real-world example. Suppose your casual mobile game generates 100,000 rewarded video impressions per month, and your average eCPM across all geographies is $9.

- Revenue = (100,000 / 1,000) × $9

- Revenue = 100 × $9

- Revenue = $900 per month

This baseline calculation becomes powerful when you start modeling different scenarios. What if you increase user acquisition and grow impressions to 150,000? Revenue jumps to $1,350. What if you improve your US user mix and raise average eCPM to $11? At 100,000 impressions, you now earn $1,100—a 22% increase with zero impression growth.

Ad revenue calculators excel at forecasting monthly revenue trajectories, estimating the impact of user growth, and evaluating new ad placement strategies before implementation. For example, if you’re considering adding a second rewarded ad opportunity per session, you can model the additional impressions against potential eCPM degradation to determine if it’s worth the UX trade-off.

The calculator approach also helps you set realistic growth targets. If you need to hit $5,000 monthly revenue at your current $9 eCPM, you know you need approximately 555,000 impressions—which helps you backtrack into the required DAU, session frequency, and opt-in rates to achieve that goal.

Segmenting CPM by Geo, Device, and Ad Placement

Treating CPM as a single average is one of the fastest ways to derail your revenue predictions. In reality, CPM varies dramatically across three critical dimensions.

Geography creates the most significant variance. A user in the United States might generate $10-15 eCPM, while a user in India brings in $1-3 eCPM, and someone in Brazil falls somewhere in between at $3-6. These aren’t minor differences—they’re order-of-magnitude gaps that fundamentally change your monetization strategy.

Device type matters more than many developers realize. iOS users consistently generate higher CPMs than Android users, often 30-50% higher in the same geography. WebGL players typically see lower CPMs than mobile, though this varies by game genre. The hardware quality, user demographics, and platform economics all contribute to these differences.

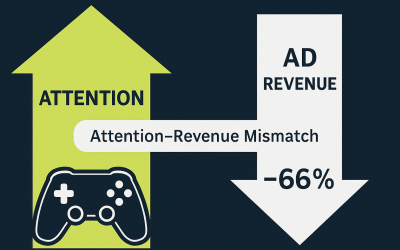

Ad placement type introduces another layer of complexity. Rewarded video ads typically command the highest CPMs because of guaranteed completion and positive user sentiment. Offerwalls can generate even higher eCPM through cost-per-action deals but require different user psychology. Interstitials sit lower because they interrupt the experience, and banners perform worst of all due to low engagement.

Why does segmentation matter for accurate forecasting? Consider two scenarios. Your app has 50% US iOS users and 50% Indian Android users. If you use an average $6 eCPM (midpoint between $12 and $2) in your calculator, you’ll be exactly right. But if your user mix shifts to 70% Indian Android and only 30% US iOS, your average eCPM drops to $4.40—a 27% revenue decrease that could blindside you if you’re not tracking segments.

Accurate forecasting requires calculating revenue per segment, then aggregating upward.

Optimizing for Higher CPM and Better Rewarded Video Ads Earnings

Prediction is valuable, but optimization is profitable. Several tactical improvements can meaningfully increase your rewarded video ads earnings.

Start with user opt-in rates. The clearer and more valuable your reward, the more users will engage with ads. Instead of vague “get coins,” specify “watch ad to earn 100 coins (10% of next upgrade).” Show users exactly what they’re working toward. Place reward opportunities at natural decision points—when they’re out of lives, need an extra move, or want to double their earnings. Context dramatically affects participation.

Ad completion rates should be monitored relentlessly. While rewarded ads naturally have high completion rates, drops below 90% signal problems. Check for technical issues—slow loading, crashes, or playback failures. Ensure the reward is granted reliably and immediately. Even a one-second delay in reward delivery can erode trust and reduce future participation.

A/B testing reveals what actually works versus what you assume works. Test different reward amounts, ad placement locations, and even the language in your call-to-action buttons. Small UX improvements compound into significant revenue gains when multiplied across thousands of users.

Consider working with multiple ad networks or exchanges simultaneously. This approach, called ad mediation, creates competition for your inventory. When multiple networks bid for each impression, CPM rises naturally through market dynamics. Platforms like IronSource, AppLovin MAX, and Google’s mediation platform make implementing this strategy straightforward.

Predicting Future CPM Trends with Historical Data

Your own historical data is the most reliable predictor of future performance—if you know how to analyze it correctly.

Start by charting your eCPM trends over time. Look for patterns beyond just “going up” or “going down.” Do you see weekly cycles? Perhaps weekends generate lower CPM because casual gamers (who convert less for advertisers) represent a larger share of traffic. Are there monthly patterns tied to advertiser budget cycles?

Seasonal patterns are particularly important. Q4 (October through December) consistently delivers the highest CPMs of the year as advertisers compete for holiday season attention. Smart developers plan for this spike—maximizing user acquisition in Q3 so they have the largest possible audience during high-CPM months. Conversely, Q1 typically sees CPM drops as advertiser budgets reset. Planning for this dip prevents panic.

Use your historical data to build seasonal adjustment factors. If your average Q4 eCPM is 40% higher than baseline while Q1 is 20% lower, incorporate these factors into your annual revenue projections. This level of sophistication separates guessing from actual forecasting.

When you predict CPM drops—whether seasonal or due to market changes—strategize accordingly. Some developers lean more heavily on offerwalls during low-CPM periods, since CPM degradation matters less when you’re earning through cost-per-action deals. Others focus on user engagement and retention during these periods, saving aggressive monetization for when CPMs recover.

AppLixir Summary: Don’t Leave Rewarded Ad Revenue to Chance

The difference between guessing and knowing your CPM is the difference between hoping your monetization works and engineering it to work. Using real data to predict rewarded video ads revenue transforms your approach from reactive to strategic.

Every insight in this guide—from understanding true eCPM to segmenting by geography, from using calculators for scenario modeling to predicting seasonal trends—builds toward a single outcome: predictable, optimized revenue that you control rather than stumble into.

Start integrating revenue forecasting into your monetization strategy today. Track the five core metrics, segment your data meaningfully, and use ad revenue calculators not just to measure current performance but to model future possibilities. The developers who master data-driven CPM prediction don’t just earn more—they build sustainable, scalable businesses while their competitors keep guessing.

Your users, your business model, and your bottom line deserve better than guesswork. Start using an ad revenue calculator and real data to understand your growth potential. The insights are there, waiting in your analytics dashboard—you just need to look at them correctly.