2025 CPM Trends: What Developers Should Expect in Q4

Contents

Understanding the Stakes

CPM remains one of the most critical levers for Game monetization, and for developers relying on ad revenue, understanding cost per mille trends isn’t optional but essential for planning and optimization. The landscape in 2025 presents unique challenges as multiple forces reshape the advertising ecosystem simultaneously. Macroeconomic uncertainty continues to influence advertiser behavior while privacy constraints are tightening across platforms, yet mobile and video advertising continue their upward trajectory despite these headwinds.

Q4 historically represents the strongest advertising season of the year, with holiday budgets flowing freely as retailers push hard. Additionally, year-end spending goals drive increased competition among advertisers seeking quality inventory. However, strong seasonality doesn’t guarantee skyrocketing CPMs, and consequently, developers need strategic positioning more than ever.

The Macroeconomic Backdrop

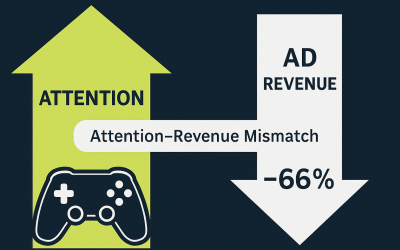

Game advertising spend demonstrates remarkable resilience despite headwinds, and in fact, U.S. mobile ad spending is projected to increase through 2025 even as tariff concerns create uncertainty across various sectors. Globally, Game ads are capturing an increasing share of digital spending as the shift from desktop to mobile continues unabated. Moreover, video formats are leading this migration with advertisers recognizing the superior engagement these placements deliver.

However, recent forecasts suggest caution is warranted as the IAB reduced its 2025 ad growth forecast significantly. Specifically, the projection dropped from 7.3% to 5.7% due to economic pressures and tariff concerns that are making advertisers more conservative. This downward adjustment carries important implications for developers, as available advertising budgets may tighten in the second half of 2025. Tighter budgets typically translate to downward pressure on CPMs, which means developers must work harder to maintain revenue levels.

Current Rewarded Video CPM Performance

Understanding where CPMs stand today provides essential context for Q4 projections, and the data reveals several important patterns for rewarded video formats across different markets and platforms.

Historical benchmarks from 2023 showed rewarded video eCPMs around $10, which compared favorably to in-stream video at approximately $6. The premium reflects rewarded video’s superior engagement metrics, as users actively choose to watch these ads in exchange for in-app rewards. Meanwhile, some market guides suggest higher averages for premium inventory, with figures of $15 for iOS and $11 for Android appearing in certain reports. However, these numbers require careful interpretation since they depend heavily on geography, app quality, fill rates, and the specific user demographics of each application.

Broader video advertising trends show upward momentum in social platforms, and for instance, Instagram’s CPM reached $9.46 in Q2 2025. Meta’s video ad influence continues shaping the ecosystem as more advertisers allocate budgets to video-first placements across their networks.

Overall, the $10-$15 range appears reasonable for premium rewarded inventory in high-value geographies like the U.S. and Western Europe. Quality matters significantly in achieving these benchmarks, with well-designed user experiences commanding higher rates than poorly implemented ad placements. However, emerging markets tell a different story as weaker advertiser demand and lower fill rates drag effective CPMs downward. Not every region will approach premium-tier numbers, and developers must set realistic expectations based on their actual user geography mix.

Additionally, these figures represent best-case scenarios for top-tier inventory, meaning many developers will experience lower yields. Consequently, optimization of frequency, mediation, and user segmentation becomes critical for maximizing revenue potential in any market condition.

Tailwinds Supporting CPM Growth

Several factors could support or lift CPMs heading into Q4, and understanding these tailwinds helps developers position their inventory strategically to capture maximum value during the peak season.

Seasonal Advertising Demand

Q4 consistently delivers the strongest advertising performance of the year as retailers dramatically increase spending for the holiday season. Black Friday and Cyber Monday drive intense competition for consumer attention, with advertisers willing to pay premium rates for quality placements. Moreover, brands pursuing year-end revenue goals often boost ad budgets aggressively to meet annual targets and maximize market share. This increased spending raises competition for quality inventory across all formats, and higher competition typically translates to better CPMs for developers with engaged user bases.

The Video Format Shift

Advertisers continue reallocating budgets toward video and in-app formats as they seek higher engagement rates than traditional display can offer. Notably, rewarded video offers compelling engagement metrics that traditional formats cannot match since users actively choose to watch these ads. This engagement quality makes rewarded inventory particularly attractive to advertisers who value completion rates and user attention over passive impressions. Furthermore, ad platforms are optimizing toward video-heavy allocations in their automated buying systems, and these platform decisions may push up effective floor CPMs across the ecosystem.

AI-Driven Optimization

Smarter bidding algorithms are improving yield management across the ecosystem, with creative optimization powered by AI helping improve conversion rates. Enhanced engagement signals make inventory more valuable to advertisers who can see clear performance metrics and attribution data. In addition, demand-side platforms are becoming more sophisticated in their bidding strategies and may bid more aggressively for high-performing rewarded placements. Better measurement helps justify higher CPMs to advertisers, creating a positive feedback loop where strong performance drives increased investment and even better rates.

Headwinds Threatening CPM Performance

Countervailing forces could suppress or flatten CPMs despite seasonal strength, and developers must understand these headwinds to manage expectations appropriately and plan conservative revenue scenarios.

Conservative Budget Allocation

Economic uncertainty makes advertisers more cautious with spending, and many are reallocating budgets to perceived safe channels like search and established social platforms. Search and established social platforms often benefit from this defensive posturing as advertisers retreat to familiar, measurable channels during uncertain times. Furthermore, the IAB’s reduced forecast signals softness in overall ad demand that may manifest more strongly later in the year. Q4 might not deliver the typical seasonal boost if economic conditions deteriorate or if advertisers have already exhausted annual budgets earlier in the year.

Supply and Fill Rate Challenges

Increased competition among developers for the same demand pool creates pressure as oversupply of inventory can dilute effective CPMs across the market. Not all impressions will command premium prices when demand remains flat but supply continues growing as more developers implement rewarded video. Additionally, fill rate issues compound the problem since ad fatigue, frequency caps, and user drop-off all impact fill negatively. When fill rates decline, realized CPMs often collapse dramatically because unfilled impressions generate zero revenue regardless of theoretical CPM rates.

User Experience Constraints

Excessive rewarded video impressions can backfire quickly, as too many ads lower engagement and completion rates among users. Reduced engagement signals make inventory less valuable to advertisers who monitor these metrics closely and adjust bids accordingly. Therefore, developers must carefully throttle and pace their rewarded placements to maintain high engagement and completion rates. Finding the optimal balance requires continuous testing and adjustment, as overly aggressive monetization strategies undermine long-term CPMs even if they boost short-term revenue.

Privacy and Attribution Challenges

Measurement constraints continue intensifying across platforms as iOS privacy features and SKAdNetwork limitations reduce attribution fidelity for advertisers. Advertisers struggle to measure rewarded video effectiveness accurately, which makes them more conservative in their bidding strategies. As a result, this measurement uncertainty makes some advertisers discount rewarded inventory or avoid it entirely in favor of more measurable channels. Lower measurement confidence translates to lower bids across the board, and the impact varies significantly by platform and geography depending on local privacy regulations.

Geographic Variability

Lower-tier geographies face significantly weaker advertiser competition, and CPMs in these regions lag far behind premium markets like North America and Western Europe. The gap between U.S. CPMs and emerging market CPMs remains substantial, often differing by a factor of three to five times. Moreover, vertical-specific factors also create variability as some industry categories may reduce spending late in the year after exhausting budgets. Category-specific weakness can suppress CPMs even in strong geographies when your user base aligns with sectors experiencing downturns or reduced marketing activity.

Q4 2025 Forecast and Recommendations

Based on current trends and historical patterns, here’s what developers should anticipate as they plan for the crucial final quarter. This forecast reflects educated projections rather than guarantees, given the unusual economic and regulatory environment shaping the advertising landscape.

Expected CPM Ranges

Premium markets including the U.S., Western Europe, and Japan should maintain strong performance with top-tier rewarded eCPMs likely ranging from $12 to $20. November and December may see brief spikes above this range during peak shopping periods, particularly around Black Friday through Cyber Monday.

In contrast, less competitive geographies face a different reality as CPMs might stagnate or even decline in some regions. Expect ranges of $3 to $8 depending on specific circumstances like local economic conditions, advertiser presence, and platform fill rates. Overall, many developers will experience flatter growth compared to previous years, with moderate gains representing the more likely outcome. Explosive CPM growth appears unlikely given current headwinds from economic uncertainty and softening advertiser demand signals.

Furthermore, month-to-month variability will likely be substantial with October and November delivering the strongest performance as holiday campaigns ramp up. However, December may soften slightly as holiday campaigns conclude and advertisers pause spending after the crucial shopping period ends.

Strategic Recommendations

Developers should diversify their monetization approach beyond single ad networks by implementing robust mediation that optimizes fill and competition. Multiple demand sources provide stability against market fluctuations and protect revenue when individual networks experience temporary demand issues. Next, focus intensely on user segmentation and targeting quality, recognizing that high-value users in premium geographies deserve different treatment. Optimize frequency caps based on user behavior and engagement patterns rather than applying one-size-fits-all settings across your entire user base.

Additionally, invest in measurement and analytics infrastructure now to ensure you understand your true eCPMs by geography, user segment, and time. Data-driven decisions will separate winners from laggards, particularly in a competitive environment where small optimization improvements compound into significant revenue differences.

Also, test different rewarded video implementations and placements. Natural integration points that enhance user experience perform better than forced implementations, as forced or intrusive placements generate lower engagement and worse CPMs. Consider seasonal inventory management strategies, building reserves of engaged users heading into Q4 to maximize your monetization opportunity during peak season. However, avoid burning out your audience with excessive ads beforehand, as fatigued users will deliver poor performance precisely when you need them most.

Finally, maintain strong relationships with ad network partners through regular communication, as direct dialogue often yields insights into upcoming demand trends. Partners may offer optimization recommendations or inventory preferences that can give you an edge in securing premium demand during competitive periods.

Preparing for Uncertainty

The 2025 advertising landscape requires adaptive strategies since historical patterns provide guidance but not guarantees in this unusual environment. Economic uncertainty and privacy changes create unusual volatility that makes rigid planning potentially counterproductive.

Developers should model multiple scenarios for Q4 revenue planning. Upside scenarios allow for opportunity capture if conditions improve, but your base planning should assume moderate outcomes rather than best-case scenarios. Instead of maximizing short-term CPMs, focus on building sustainable monetization that supports long-term user retention and engagement. Long-term user retention and engagement support better monetization over time, as aggressive short-term tactics often backfire by degrading user experience.

Furthermore, monitor leading indicators throughout Q3 to refine Q4 expectations and make necessary adjustments. Early October performance often signals broader Q4 trends with reasonable accuracy, so adjust strategies quickly based on emerging data rather than waiting until mid-quarter.

How AppLixir Can Help You Maximize Q4 Revenue

Navigating the complexities of Q4 CPM optimization doesn’t have to be overwhelming. That’s where AppLixir comes in. Our rewarded video ad platform is designed specifically for developers who want to capture premium CPMs without sacrificing weeks on complex integration. With seamless implementation that takes hours rather than days, you can focus on what matters most: building great apps while we handle the monetization optimization that drives results.

AppLixir consistently delivers above-average CPMs by connecting you with premium demand sources and optimizing fill rates in real-time across all geographies. Our platform leverages intelligent ad serving technology that maximizes revenue per impression while maintaining the user experience your players expect. Whether you’re operating in tier-one markets or emerging geographies, AppLixir ensures you’re getting the CPMs you deserve heading into the crucial Q4 season.